AI Demand Letter Video Available with Settlement Intelligence License

Share

AI Demand Letter Video by Settlement Intelligence

AI Demand Letter platform Settlement Intelligence has posted a two hour educational video discussing methods personal injury lawyers can use to improve their settlement offers in auto cases. The video is free for all law firms licensing its platform, and provides lawyers and their staff a wealth of information about why certain methods help improve settlement offers, while others damage your law firm's credibility and settlement offers. In addition to addressing fundamental issues pertaining to demand letters, Charlette Sinclair and Aaron DeShaw address the benefits and detriments of using the presently available AI demand letter technology.

The following is the opening segment to the video, that will be of interest to personal injury law firm who settles auto cases.

Edited Transcript:

Settlement Intelligence Co-Founder Dr. Aaron DeShaw, Esq.:

"Welcome everybody. We're going to spend today looking at settlement demand letters, and whether we can make changes in regard to settlement outcomes for your law firm and your clients. We've been doing a survey on demand letters and settlement offers in personal injury cases for the last week. And if you haven't done it already, I'd love to see you participate in that, and let other lawyers you know to participate in it as well. We're trying to get as much information as possible in regard to how law firms are doing their demand letters, and how they can improve their settlement practices. The survey looks at what styles of demand letters are presently being used. What seems to be working, and what's not? I think that it's helpful to better understand trends in the legal field.

Today, we're going start by covering the preliminary results that were available as of this morning. I pulled some of the graphs and here are the preliminary results.

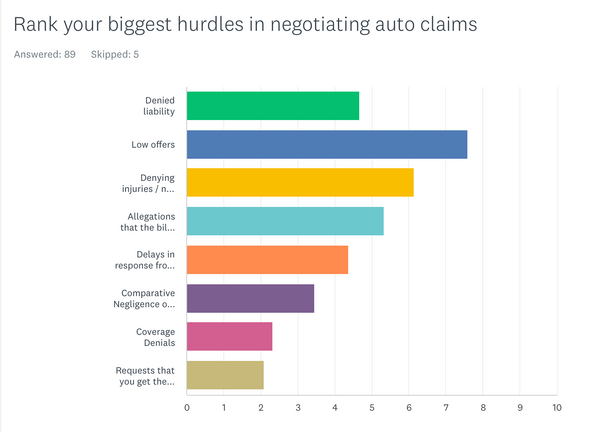

So the number one problem that lawyers are reporting probably won't surprise most of us, and it's the low offers made by insurers. Then next denied injuries or a refusal to provide compensation for those injuries. The next highest concern is allegations by the insurer that the client's treatment bills are too high. Then denials of liability. And the list goes on.

So, lets get to the heart of what is causing these problems. Insurers have implemented claims software so they can intentionally make settlement offers that are consistently too low. I don't know how many of you know that. But I uncovered that information back in 2001. According to my research, in the United States the use of bodily injury claim software started with USF&G and G in 1992. Then it was adopted by Allstate in 1995, and it really just spread from there. These companies initially used a software called Colossus. It was part of Allstate's roll out of their new claim settlement practices in 1995 (called CCPR). We believe the reason the use of this software spread so quickly is that other insurers watching what happened with (Allstate's) payments out on claims and their profitability. [Colossus and other aspects of CCPR led to a massive fall in claim payments, and a massive increase in profits.] Then, in the mid-90s most of the other auto insurers jumped on board and started adopting Colossus.

I know from my research of non-protected documents, and insider interviews that when the insurance companies implemented Colossus they intentionally set the program to underpaid claims. [They had their own adjustors determine the value of claims and then would set the Colossus system to mimic the valuations, but decreased the values in the computer system so that every claim would result in an underpayment of the claim.] And so, for those of us that have been practicing [motor vehicle] law only since the implementation of Colossus, all we've ever really known is claims that were intentionally being underpaid. If you were not already aware of that coming into this lecture today, you have to understand that's part of what's going on right now - the computer systems being used to set the settlement offer values is offering you less than what the insurers own adjustors believe is the correct value.

Those bodily injury claims systems are in place for over 90% of the third party auto claims in the United States. And so you're constantly dealing with a system like that, that's set to underpay your claims.

If you are an intelligent person who wants to obtain the best outcome for your clients you obviously need to know everything you can about these systems. Because not knowing everything you can about them leaves every one of your auto clients susceptible to getting far lower offers than they deserve. Because the insurer intentionally setting the system to underpay claims isn't the only problem with the software that results in low offers.

So, you need to know everything you can about computer systems like Colossus going into your attempts to settle with insurers. You have to figure out "are there ways for me to work with this in in order to get as high of a settlement value as I can, so that the client can then make a decision. Do they want to accept what we already know to be an undervalued claim? Or do they want to go forward to trial?"

As a related issue, I think you have to go into these settlement attempts knowing that every settlement offer will be lower than its fair value. Almost all third party offers that are dealt with through insurance claim software are going to be bad faith, because they're knowingly undervaluating them. And many of the insurers use these in the first party context still, and in those cases the insurer is knowingly underpaying their own policyholder. And certainly the profession should be taking on more insurance claim practice or "Bad faith" claims against insurers for this type of intentional underpayment.

But getting back to the individual cases, is there something that we can do to improve settlement offers? And the the answer is, yes. After looking at this issue for many years there are two primary things you can do for your clients; 1. You have to optimize the settlement demand letters for the insurance software to obtain the maximum settlement offer, and 2. you have to start going to trial.

One thing I wanted to acknowledge here is is that none of us probably went to a law school that taught us how to write demand letters. And so many of us just came into the profession fumbling around and trying to figure out. You know... "what's the best way for me to do this?"

And as the person who's run Trial Guides over the past 20 years, including the publishing for AAJ, and tracking the statistics on litigation in the United States, I find it fascinating that with 98-99% of tort cases settling prior to the filing of litigation, and more cases settling after that, that the plaintiff's bar almost never discusses its methods of writing demand letters or settling cases.

Getting back to our question then; "what's the best method for me to write demand letters?" Is it a medical timeline? Is it a straight narrative? Is it some other thing? Many of you started in a law firm working for someone with experience practicing law, and I expect that most of you used whatever method they suggested. And they learned it from whoever trained them. Way before insurers started using claim software, and discarded the way things were done on their end of the claim evaluation. But, we are talking about days when an adjustor used to drive to your office and sit down and discuss the case with you. Those days are long gone, and the methods used back then are not effective since software was adopted in the mid-1990s.

It was really not until I came upon the information on Colossus in 2001 and started doing the research on claim software that I understood the way that claims were being evaluated in the auto insurance industry.

And so I just want everybody to know as we go into this lecture - you can't find yourself at fault for writing demand letters in a way that is ineffective for today's claim handling.

Now, I've been lecturing about this topic for 20 years now. If you have heard Charlette or I lecture on this topic before, often in very detailed sessions about how to write the demand letters step by step, I just want to emphasize that things haven't changed much. In fact, they've gotten worse over time. Primarily, because State Farm finally ended up adopting claims assessment software as well. And that was the big percentage of first party and third party auto claims in the US were not being evaluated by claim software up until a few years ago. But now, I believe every major auto insurer in the United States is using bodily injury claim software.

Styles of Demand Letters Used by Personal Injury Lawyers

So let's move on to the different ways that lawyers have addressed demand letters over the years.

1. One Page Demand Letter.

One style is being very brief. What I often call the "one page demand letter," and then you include the bills and the records and other things such as expert reports, and send them off to the insurance company. And there are reasons for doing that. I think that the best use for a one page demand letter would be in a clear policy limits demand letter. I know the laws on this differ in each state, but these work well when you have some idea what amount of coverage the third party has, or you know that you've got a small UM or UIM case, and you're just sending it off because the insurer is highly likely to pay the policy limit given the facts of the case and the insufficient insurance coverage.

2. Pure Narrative Demand Letter.

We've known for some time, that a "pure narrative" demand letter is not very effective in cases that have more common types of injuries. Particularly in spinal cases or what the insurers refer to as "soft tissue injury" type claims. In our prior interviews with adjusters and claim supervisors, one of the things that became evident was that they did not find a lawyer's long and detailed discussions of a client's pain to be helpful because the insurer's computer systems have pre-set values for pain based upon the diagnosis. So, time and space used on issues like that, provide little or no additional value. What they need is very specific data on diagnosis, treatment, providers and much more. Often with pure narrative demand letters, this type of detail is missed.

For reasons we will discuss later, using narrative explanation of the injuries is much more valuable in specific types of injuries, or in catastrophic injury cases. And we're going to talk about the specific types of injuries where narrative is required. And why a narrative description of those injuries is required to get the best settlement offers in cases involving those injuries.

3. Mixed tables and narratives based on insurer software use.

This is the one I've been advocating for, you know, 20 plus years now. Again, there's a reason for that, and and we'll talk about that a little bit today. But not nearly as much as some of you have heard Charlette and I lecture on that issue before, because we're going to address some very specific issues today pertaining to concerning trends that we're seeing in the field.

4. Medical Timeline Demand Letters

Medical timeline demand letters, and by extension AI medical timeline demand letters, are not very effective. Both Charlette and I have had many discussions about this over the 20+ years we've been writing and consulting on demand letters.

This opinion is substantiated by people handling claims by the insurance companies themselves. Both of us have been told by adjusters and claim supervisors over the years when we do interviews that medical timeline demands are not effective because they are disregarded. Charlette also does focus groups with insurance claim adjustors and she has also gotten feedback on this issue supporting that medical timeline demands are disregarded. Lastly, both of us have gotten similar feedback from insurance claim experts who were formerly employees at insurance companies. The consistent message we have gotten from these interviews and focus groups is that medical timeline demand letters are not effective. To be very upfront, generally what we've heard since the early 2000's is that the adjusters and supervisors will oftentimes put these medical timeline demand letters aside and read the records themselves. We've been told that the insurers ignore the demand letter when the demand letter is primarily a medical timeline.

For that reason, I just don't think that medical timeline demand letters are very effective. And I've been saying that for twenty years.

5. "Bad Faith" Demand Letter

And then there is what I call a "bad faith" demand which can be effective, particularly in first-party cases if you have good law on first party bad faith in your state.

In the first-party context where you are writing to the client's insurer, you start with a demand letter that mainly talks about the purpose of insurance in society and the fact that the policyholder is injured. Discuss the length of premiums paid so that if the policyholder ever has a loss, they can rely upon the insurer to pay the claim promptly, fairly and fully. And then you note that "we'd request the policyholder's insurance benefits at this time."

This type of demand letter doesn't provide very much detail in regard to the client's injuries, and it leaves the adjusting function where it belongs - on the insurer. This style of demand letter instead discusses the purpose of insurance in society and the fact that the insurer's policyholder needs the monetary payment of insurance coverage to cover their losses without delay, and without unnecessary litigation. Keep in mind the tone of this type of letter because if it becomes a bad faith claim your demand letters will likely be an exhibit in the bad faith case and you may end up being a witness.

And for the insurers that are really mandating that their adjusters use the bodily injury claim software in first party claims, my past experiences suggest they're not going to be able to enter a claim with sufficient detail in order to get the claim up to whatever value it is that you're seeking. Meaning the settlement amount you've requested or the policy limit. And then by failing to pay the policy limit on a case that deserves it, the insurer is caught setting their software to intentionally underpay claims, and the adjustor fails to correctly enter all of the information of value into the software.

I come from a background of researching and handling insurance bad faith and insurance class action cases in the early part of my legal career. I feel like this was excellent training for my personal injury practice now, because I try to give the insurer every chance to do the right thing and they frequently still make a completely unreasonable offer both in first party and third party cases.

In addition to the mixed table and narrative style demand letters I discussed above, I also use bad faith demand letters regularly in my practice. In first party cases I may send something that is designed to fully trigger their insurance software, without any threat of a potential bad faith case if they make a bad offer. If the offer in response isn't good, then in first party cases, I'll send the letter I described above, talking about the importance of insurance coverage, and then cite the first party bad faith law.

The same is usually true for third party cases. I almost always send a demand letter optimized for the insurer's software, and if it doesn't work, I send a second insurance bad faith demand letter citing the improper offer and then citing the case law in that state for third party bad faith (where applicable.)

So, bad faith demand letters of different styles can be used as a backup to the main demand letter, using a different style.

Demand Letter Styles in the Trial Guides Poll

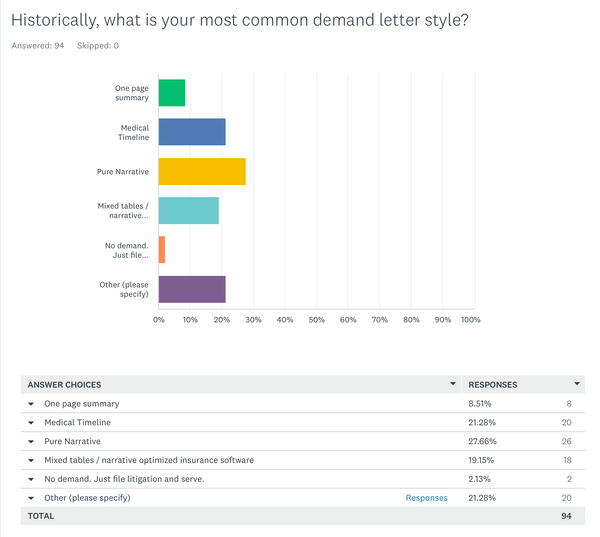

So in the poll, this is what we're seeing right now.

As you can see, "pure narrative" demand letters are the most commonly used amongst the lawyers who have taken the poll so far.

Medical timeline was the second most popular style.

Mixed tables and narrative is the third most popular style of demand letter amongst the lawyers taking this survey.

We do have some people that do one page summaries.

And then there were a number of respondents that said "other," and I actually pulled those out because it reflects the fact that you are trying to do what you can to come up with the right outcome based upon what I am guessing are the outcomes of your cases in the past. One respondent said "mixed narrative regarding liability, medical treatment, medical expenses, wage loss demands, exhibits and so forth like that. And I think that's a great method to use. Another person said "cover letter and closing medical records, bills and documents asking for an offer. Another said demand policy limits or offer within policy limits, no description of liability or damages." And you can kind of see these other responses. But but what you're seeing here is kind of a mix and match of a variety of different methods.

Problematic Insurance Companies

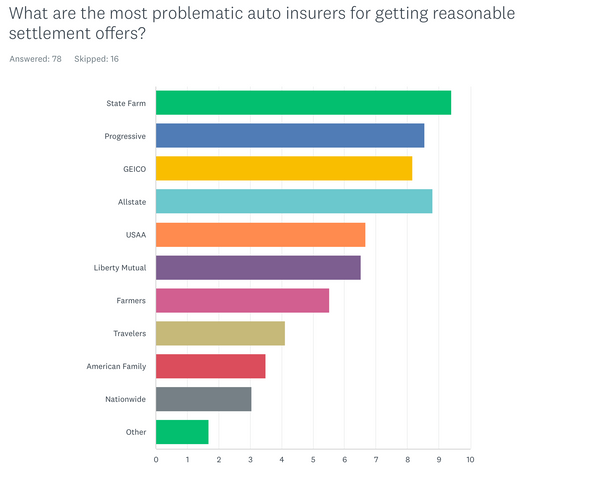

So which insurance companies are making the lowest settlement offers according to our survey participants? It looks like State Farm is the biggest problem. Allstate is also a big problem right now, followed by Progressive at #3, and Geico at #4.

Interestingly enough, as of a day or so ago, Liberty Mutual and U.S.A.A. were competing for the worst, but that shifted, as many more people took the survey. The present results show USAA as the #5 worst, and Liberty Mutual as #6 worst.

So, moving on. As I mentioned earlier on, bodily injury software has been used in the United States since the early 1990s. It really came into fuller effect in 1995, and just subsequent to that when insurers saw the financial results Allstate achieved using Colossus. Many insurance companies adopted Colossus, which was the first first program.

Next we turn to a different program that is now called "Liability Navigator." "Lnav" is how many of the adjusters will refer to it. Is the program formerly known as "Claims Outcome Advisor" or "COA." This program was developed by the same team that had developed Colossus in Australia in the 1980s. But about 10 years later in the mid-1990s they created a system that is similar, although different in important ways.

The good news is Charlette and I - mainly Charlette has obtained some really good information on Claims Outcome Advisor that she shared with me. And then very recently we received a treasure trove of substantial documents on Colossus, Liability Navigator, ClaimIQ, and a number of other programs used in auto, premises and workers compensation claims. We are analyzing those presently.

So the last of the major software systems used by insurers, is called ClaimIQ. It's now owned by Mitchell International or its parent company. And it's slightly different. And it's being used by some of the largest of the large auto insurance companies.

That system is slightly different. It was developed by different people. And there's some things that ClaimIQ stresses a little bit more than the others.

Optimally, you want to know what insurer uses what software, and then to optimize your demand letter for that type of software so that your clients injuries are correctly entered by the insurance adjuster and the best settlement offer you can get from the insurer's computer system is provided to you. As I noted above, the insurer knows when making the offer that it isn't the full amount. This will not be swayed by artificially inflating the economic damage numbers, claiming things that aren't proven within the medical records, or by someone else's verdicts. The computer system makes a determination of claim value based upon the factors in your case that are supported by the medical records. That's it. The decision you and the client need to make at that point, is whether you will settle for the amount offered, negotiate or go to trial."

Settlement Intelligence is an AI demand letter platform that uses decades of expertise in insurance claim software to collect the necessary data from you and then creates the demand letter in a format that is optimized for the insurer who will evaluate the case.

If you license Settlement Intelligence, contact support for a link to the video for your law firm. This is part of the Settlement Intelligence Learning Center, that will help lawyers and legal staff to improve their case outcomes.

Author

This blog was written by lawyer Aaron DeShaw, author of the only legal treatise on insurance claim software, nationally renowned expert on personal injury demand letters, and founder of Trial Guides.